-

Whatsapp:

+1 -

Email:

[email protected] -

Location:

71-75 Shelton Street, Covent Garden, London, United Kingdom, WC2H 9JQ

The foreign exchange market (Forex or FX) is a global marketplace where national currencies are traded. With daily volumes reaching the trillions of dollars, it is the largest and most liquid financial market in the world. Forex trading involves simultaneously buying one currency and selling another, with the aim of profiting from changes in exchange rates.

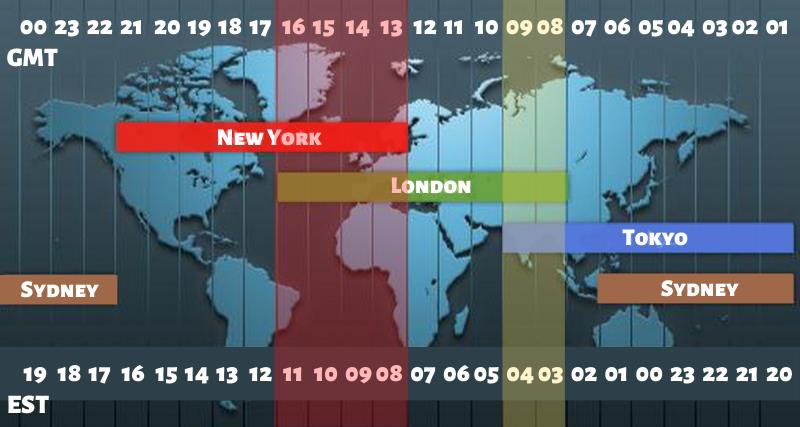

Unlike stock or commodity markets, the Forex market operates 24 hours a day, five days a week, from Monday to Friday. This around-the-clock accessibility is made possible by overlapping time zones across major financial centers such as London, New York, Tokyo, and Sydney. Retail traders can participate in Forex through online brokers, enabling them to speculate on the price movements of various currency pairs from any location with an internet connection.

Whether you’re a beginner seeking to learn the fundamentals or an experienced trader looking to refine your strategies, understanding how Forex works is vital to navigating this fast-paced market effectively. Below, we break down essential elements, including FX pair structure, types of currency pairs, common trading terms, and key market participants.

Forex transactions always involve two currencies, forming what’s known as a currency pair (e.g., EUR/USD). In this example, the Euro (EUR) is the base currency, while the US dollar (USD) is the quote currency. The price of a currency pair indicates how much of the quote currency is required to purchase one unit of the base currency.

For instance, if EUR/USD is quoted at 1.2000, it means 1 Euro can be exchanged for $1.20. The exchange rate fluctuates due to various factors such as economic data releases, geopolitical events, and changes in market sentiment.

:max_bytes(150000):strip_icc()/GettyImages-483658563-fbe002bf7f6d467a94d87cd153ddfa73.jpg)

Understanding the nature of each type helps traders select the right pairs that match their risk appetite and trading strategy.

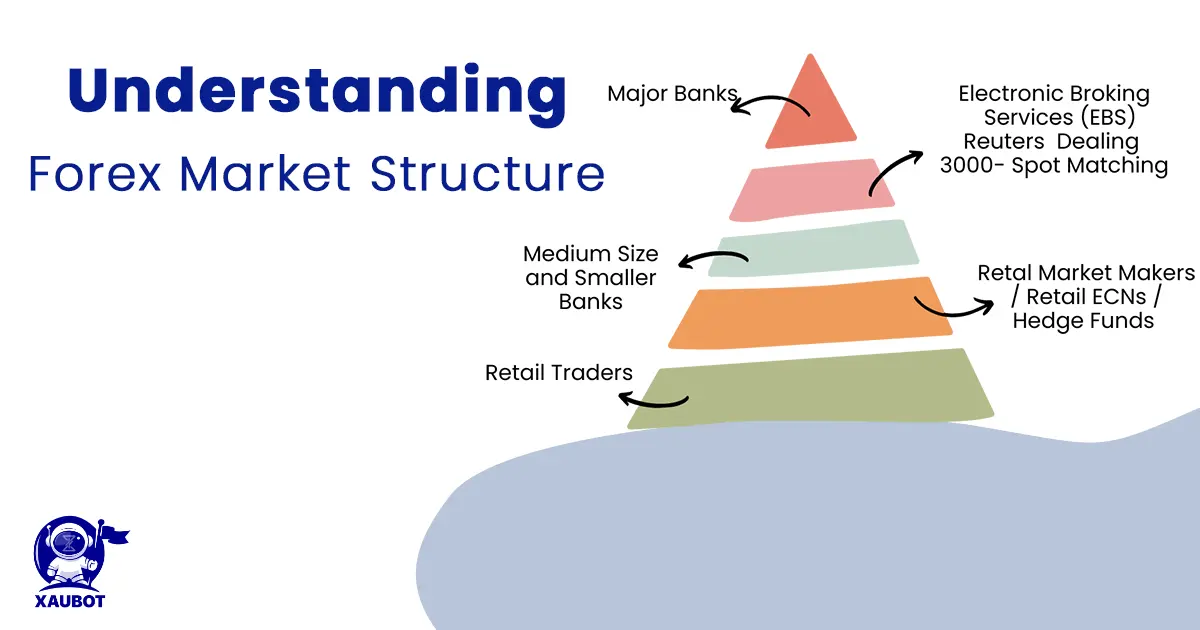

The Forex market is composed of various entities, each with specific roles and objectives:

Understanding how these participants interact helps traders anticipate market movements and potential volatility.

The Forex market operates through multiple trading sessions around the globe:

The best time to trade often depends on currency pair liquidity and volatility preferences.

Technical analysis often relies on charts to track price movements over time. Popular chart types include line charts, bar charts, and candlestick charts, which offer insight into opening, closing, high, and low prices within a given period. Indicators like Moving Averages, RSI (Relative Strength Index), and MACD can help traders identify trends and potential entry/exit points.

Mastering chart analysis is a critical step in developing a consistent trading strategy.

Forex trading involves significant risk of loss and is not suitable for all investors. Leverage can work both to your advantage and disadvantage. Before deciding to trade Forex, carefully consider your investment objectives, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment.

Always seek independent financial advice if you have any doubts.