-

Whatsapp:

+1 -

Email:

[email protected] -

Location:

71-75 Shelton Street, Covent Garden, London, United Kingdom, WC2H 9JQ

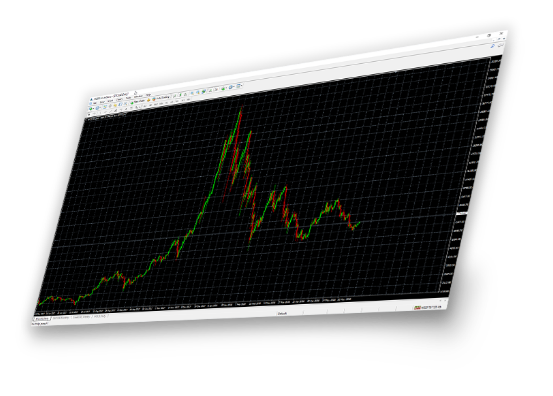

MetaTrader 5 (MT5) is a multi-asset trading platform widely used by traders worldwide for Forex, CFDs, stocks, and futures. It offers advanced charting, automated trading through Expert Advisors, and a range of technical indicators. Designed as the successor to MetaTrader 4, MT5 provides enhanced features for analytical depth, trading strategy testing, and expanded market access.

The platform’s user-friendly interface and powerful functionality make it suitable for both beginners exploring the markets and experienced traders managing diverse portfolios. Below, we delve into its advantages, key features, and considerations for effectively using MT5 in your trading journey.

Beyond its robust charting capabilities, MetaTrader 5 includes a suite of tools to streamline your trading experience:

These features help traders stay informed, automate routine tasks, and refine their approaches for better results.

MT5 connects you to your broker’s servers, providing live price feeds and trade execution. From your MT5 terminal, you can place market or pending orders, manage open positions, and analyze price movements. Key elements include:

Always verify your broker’s MT5 offerings, like available assets, spreads, and leverage, to ensure they fit your trading plan.

While MetaTrader 5 provides powerful tools and advanced capabilities, proper risk management remains essential:

Even the best trading platform cannot guarantee success—discipline and sound risk control are key.

Trading on MetaTrader 5 involves risk. Rapid price movements, leverage, and market volatility can result in losses beyond your initial deposit. Understand the potential downsides before integrating automated strategies or increasing position sizes.

Seek independent advice if necessary and practice prudent risk management. Past performance is not indicative of future results.